Minimum withdrawal 401k calculator

Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money. SECURE Act Raises Age for RMDs from 70½ to 72.

What Is A Required Minimum Distribution Taylor Hoffman

Find out when you should withdraw from your retirement savings and perhaps use your 401k to retire early.

. Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Anything your company contributes is on top of that limit. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

In 2022 you can contribute 20500 to a 401 k. How Do You Calculate A 401k Withdrawal At Age 70. The second by December 31.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Ad If you have a 500000 portfolio download your free copy of this guide now. 2022 Retirement RMD Calculator Important.

You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you. As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020. You are retired and your 70th birthday was July 1 2019.

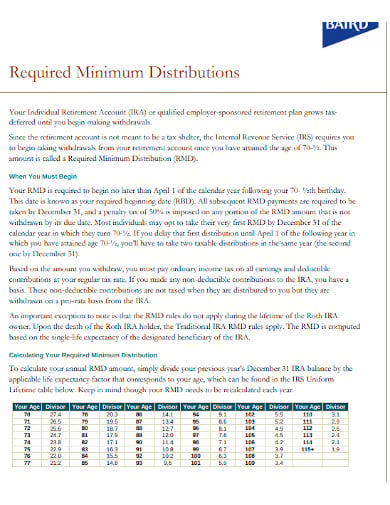

It then uses the. The SECURE Act of 2019 changed the age that RMDs must begin. Required Minimum Distributions RMDs generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she.

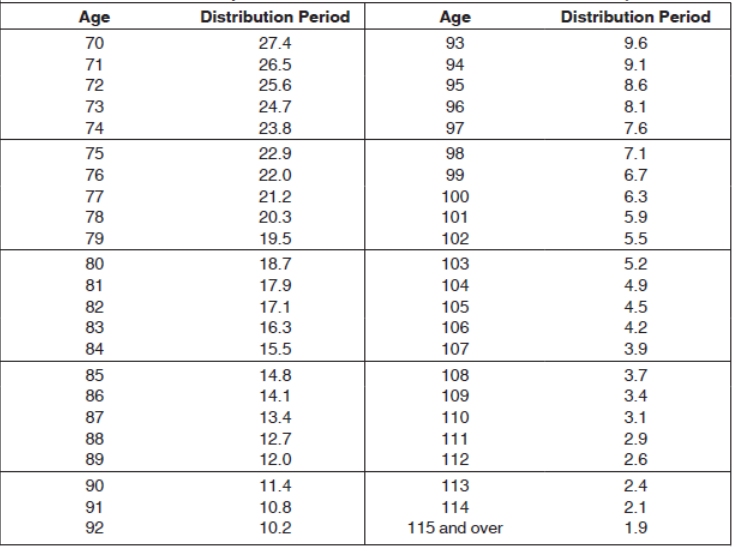

This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

48 rows This retirement calculator lets you build up your traditional IRA or 401 k balance up until age 70 12 when you must start making taxable distributions. Required Minimum Distributions RMDs generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 70 ½ if. 401k minimum distribution calculator Jumat 02 September 2022 Edit.

Calculate your required minimum distributions RMDs The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and. The distributions are required. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

Discover The Answers You Need Here. As an example we will enter 100000 as. Starting the year you turn age 70-12.

Ad Understand The Potential Impacts Of Withdrawing Early From A Retirement Account. A Roth 401k is an account funded with after-tax contributions. Those who are 50 years or older can invest 6500 more or 27000.

Required Minimum Distribution Calculator. Ad Use This Calculator to Determine Your Required Minimum Distribution. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

Ad From Life Retirement Planning To Investing Our Free Calculators Are Here To Help. Can You Withdraw Your 401k If You Quit Your Job. As an example we will enter 100000 as the account.

Note that if you delay your first RMD until April youll have to take 2 RMDs your first year. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. The first will still have to be taken by April 1.

News You Should Know Irs Changing Rmd Rules For 2022 Pera On The Issues

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Distribution Calculator Estimate The Minimum Amount

Rmd Table Rules Requirements By Account Type

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Did I Just Retire At Age 52 Video In 2022 White Coat Investor Retirement Planning Early Retirement

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Rmd Table Rules Requirements By Account Type

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Rmd Calculator Required Minimum Distributions Calculator

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

How To Calculate Rmds Forbes Advisor

Here S How To Calculate Your Required Minimum Distribution From A Traditional Ira Or 401 K The Motley Fool The Motley Fool Personal Finance Printables Student Debt Required Minimum Distribution

Understanding Required Minimum Distributions Shotwell Rutter Baer

Required Minimum Distribution Calculator Estimate The Minimum Amount